Big Five

Consider your investment decision of a stock that has just registered a new high. Before any analysis is undertaken, would you, instinctually tend to be more inclined to buy or sell? If we continue on this openness to selfevaluation discussion, an investor who is more characterised by optimistic/extraverted emotionality may intuitively tend to be a buyer versus another who is higher in negative emotionality or conscientiousness may be more inclined to holding back. This is not as much a discussion of investment return as it is about the biases that is inbuilt in any investor’s decision making process and at times, the unconscious factor that influences decisions. This behavioural factor of investors plays a more prominent role at potential pivot points of markets, where cognitive biases tend to come to the fore, a few of which had been discussed above. Are there any more cognitive biases currently at play in your decision making?

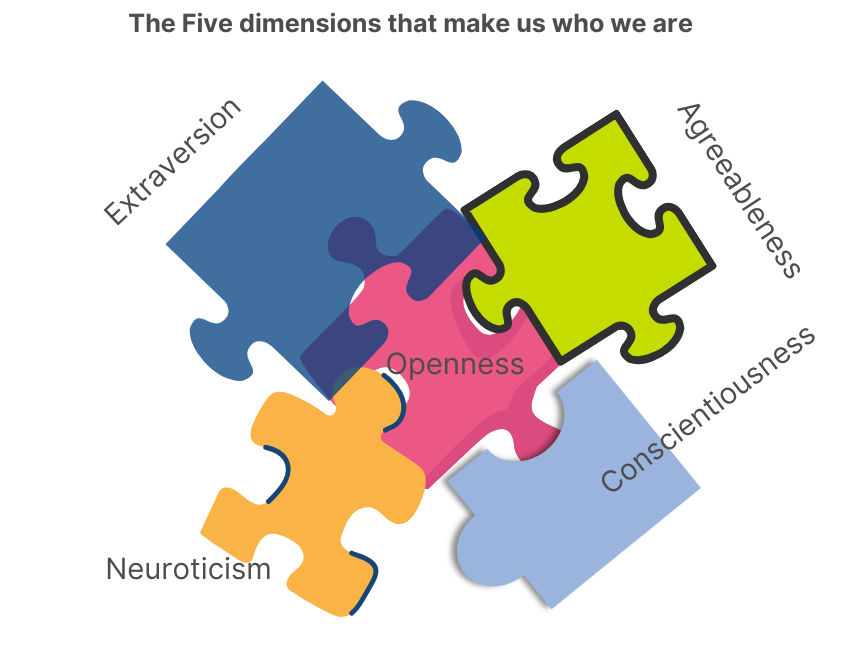

Diagram 1 below depicts the five factors of an old theory: developed in 1949, the Big Five sets out to describe the five big dimensions of our personality.

Diagram 1: The Big Five Personality Traits

Curious to discover what your more dominant dimension(s) may be? Find out in 5 minutes by taking our Money Personality Quiz!