Australia’s Property Market at Mid-Year 2025: RBA Moves, Mortgage Pressure, and REIT Strategy

As we enter the second half of 2025, Australia’s property market is at a pivotal moment. The Reserve Bank of Australia has paused its rate-cutting cycle after an initial move in May, while inflation continues to ease and consumer confidence begins to stabilise. Against this backdrop, housing prices are rising steadily, and investor attention is returning to real assets.

Read More

Rebuilding Value: How AI and Technology Are Reshaping the ASX in 2025

The Australian technology sector has entered a period of renewed growth and strategic transformation in 2025, following a prolonged phase of underperformance between 2022 and 2024. This resurgence is not solely driven by market sentiment, but by fundamental improvements in how technology companies operate, monetize their offerings, and deliver tangible business value.

Read More

Beyond Tariffs Strategic Realignment in Australia–India Trade and Investment

On May 12, 2025, the U.S. and China reached a pivotal agreement to pause mutual tariffs for 90 days, signifying a rare moment of easing tensions that have significantly influenced global trade patterns in recent years. However, it is crucial to understand that this temporary calm does not guarantee lasting stability. While market reactions might focus on these headline developments, astute investors should focus on a more profound and strategic transformation: the reorientation of Australian trade flows, particularly with India.

Read More

From Dental Student to Specialist: Navigating Career Choices with Personality Insights

Embarking on a career in dentistry can be daunting, given the myriad of specialties and work environments available. While clinical skills are crucial, personality traits significantly influence career satisfaction and success. This article explores how the Big Five Personality Traits can shape your work style, patient interactions, and choice of dental specialty.

Read More

Financial Planning for Dentists: Investment Strategies Based on Your Personality

As a dentist, financial planning is a critical aspect of your career, especially given the unique challenges you face, such as high student debt, the complexities of practice ownership, and the need for effective retirement planning. Navigating these financial waters can be daunting, but understanding how your personality traits influence your financial decisions can be invaluable. Your personality not only affects your risk tolerance but also shapes your investment strategies, leading to more tailored and effective financial planning.

Read More

Beyond Clinical Skills: How Self-Awareness Can Elevate Your Dental Career

Dentistry extends beyond clinical expertise; it requires strong leadership, teamwork, and business acumen. While technical skills ensure precision in treatments, self-awareness serves as the foundation for career growth and professional success. Understanding your personality can refine your communication style, enhance decision-making, and foster a thriving workplace culture.

Read More

How Personality Shapes Your Dental Career

Your personality isn’t just about how you interact with people—it also influences which dental specialty and work environment will bring you the most fulfillment. The Big Five Personality Traits—Openness, Conscientiousness, Extraversion, Agreeableness, and Neuroticism—offer valuable insights into which path may suit you best.

Read More

Big Five and Neuroplasticity

Why the Big Five? Understanding the workings of our own Big Five gives us insights into and may even predict how we will react, think, decide, feel and behave when circumstances arise. As much as it is important for a share/derivatives trader, so it is for medical professionals who are involved in emergencies or critical patient care.

Read More

Money Personality and its effect on Net Worth

Investors constantly look for the best investment ideas to deliver the returns they desire. Be it the promise of an investment instrument, or an expert's view or the best-performing fund, our hopes hinge on making the next best call. But there is one area that is usually overlooked - your "Money Personality" and how it affects your investment performance.

Read More

The Moving, Moving Parts

As investors move towards second half of the financial year, the moving parts of the markets are moving again. By the end of June '24, as the financial year concluded, the Australian stock market saw a 12% increase (dividends included). During this same period, the S&P 500 has maintained a robust growth of 21.5%. As investors move towards second half of the financial year, the moving parts of the markets are moving again.

Read More

Central Banks Policy Rates

June 2024 expectation of interest rate paths by JP Morgan

Read More

The story continues in May

After a decline in April, the markets regained stability and achieved a slight increase for the month. As of June, the overall market situation appears stagnant, but beneath the surface, there are significant sector rotations and divergences.

Read More

New clinic purchase

Are you looking to buy a clinic or start one? We can help with finance and more.

Read More

Hazily Constructing

As we move into mid May, let’s evaluate three top of mind questions: Is this positive trend sustainable, have I missed the rally and should I be investing more of the same for the rest of year?

Read More

Invest Smarter with SMSF Property Purchase

Unlocking the Potential of Property Purchase with an SMSF Structure

Read More

Stealthily Higher

As equities markets around the world climbed stealthily higher in March, we investigate if economic strength undergirds the Australian market. We take a bottom-up approach; starting from households to small and then listed businesses.

Read More

LMI waiver for nurses

Registered nurses may be eligible for Westpac's medico LMI waiver policy up to 90% LVR. Minimum income threshold of $90,000 per annum.

Read More

Buying a clinic

Purchasing a clinic is a big commitment and an arduous task. Obtaining finance is only the start

Read More

Steady as she goes

The month of February was about “old” highs being smashed and new highs reached. Let’s take a look at what’s been going right and what needs to be right for us to be alright.

Read More

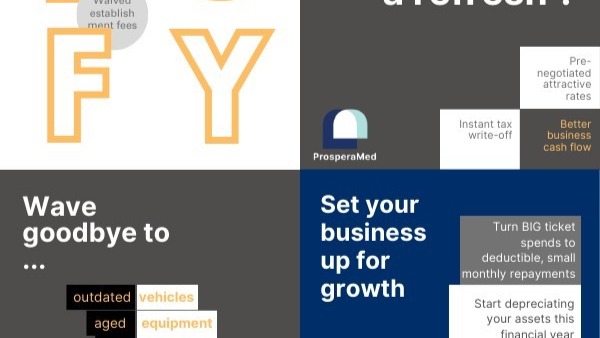

Equipment purchase

Are you looking to buy a medical equipment but have less than 1 year business history?

Read More

The Big Five Money Personality

Do you know what your Big Five Dimensions are? What is your Money Personality?

Read More

New High, How High?

If January 2024 was the month when Indices climbed towards their previous all-time highs and slightly more, then February would be the month mindsets were broken and a new psychological level of 7700 breached.

Read More

Year-End Cheer

Where did the year end cheer come from? Let's take a look together.

Read More

Three In a Row

October brought the third down month in a row for the ASX. Many of the issues markets were contending with are still being played out. Investors continue to have the need of balancing the scale of a soft landing on one side and recession on the other.

Read More

Still Unsettled

In the month of September, we saw indices going backwards. In addition, following the FOMC meeting the US experienced a 10 year Treasury yield surge.

Read More

An Unconventional Strategy for Managing Sequencing Risk

If you think Sequencing Risk is that of a consideration of older investors, then you can't be more wrong - starting early has the benefit of time working on your side.

Read More

Learn About Sequencing Risk

Investors should structure their investments in a way that can help manage Sequencing Risk.

Read More

Sequencing Risk Explained

The timing of negative returns could leave one vulnerable to Sequencing Risk, and can have a great negative impact on the value of one’s wealth at retirement.

Read More

Your Trading Plan Should be your Best Friend

When you have a hunch about a stock or a sharp instinct for a trade, the first step should not be to follow it, but to make a trading plan.

Read More

Know Yourself Before You Trade

Trading is as much about knowing yourself as it is about the techniques, and once you understand yourself as a trader, you can begin making smarter, more informed trading decisions.

Read More

Stock market Report Card for August 2023

Looking forward from August, we are back to focusing on the interest rate rhetoric. The timing of the US recession and China have implications for Aussie stocks beyond that of global economic growth

Read More

Powering On

In July 2023 the market moved further towards a 'Goldilocks' sweet spot.

Read More

Are we Entering Goldilocks?

In June 2023, we entered a period of growth, but will earnings be resilient?

Read More

Hand in the Pocket

May 2023 seemed to have been a month of low volume, with market participants' hands in the pocket.

Read MoreStay in the know, Subscribe to the ‘View

Our newsletter provides you with the latest and most important happenings in the industry.